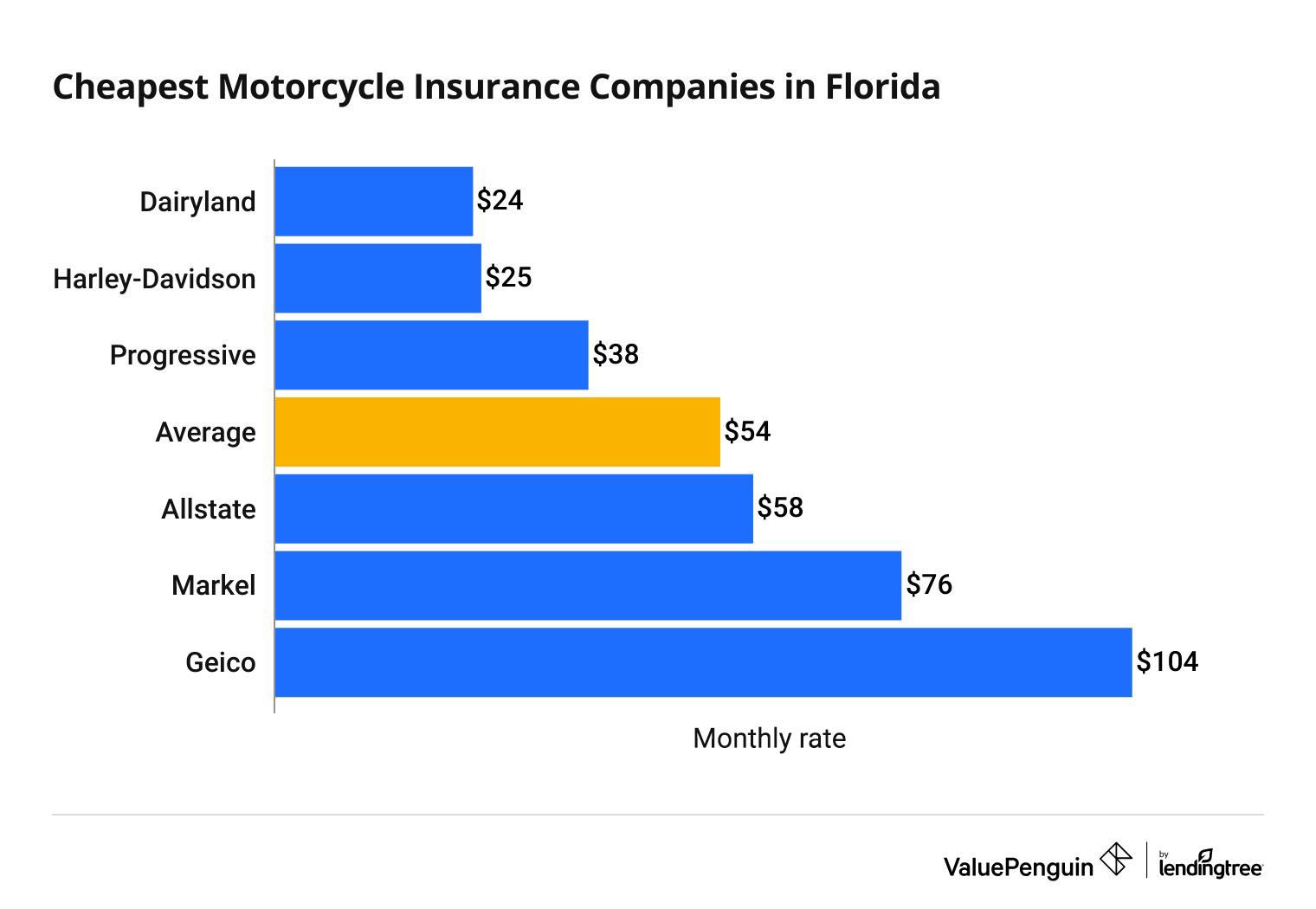

The cheapest place to get motorcycle insurance in Florida varies as rates depend on personal factors and the provider. Riders should compare quotes online for the most affordable options.

Navigating the ins and outs of motorcycle insurance in the Sunshine State can be as complex as the state’s diverse roadways. Securing economical coverage requires a careful look at a multitude of insurance providers, as premiums fluctuate based on age, driving record, and the type of motorcycle owned.

Florida riders aim to find insurance that meets their needs without breaking the bank. To minimize costs, it’s essential to gather quotes from multiple sources. Insurance comparison websites offer a convenient way to evaluate a variety of policies quickly.

With the right strategy, motorcyclists in Florida can rev up their engines with the peace of mind that comes from having reliable, yet affordable, insurance coverage. Remember, the cheapest option isn’t always the best, so it’s wise to consider the balance between cost and coverage quality.

Table of Contents

Florida Motorcycle Insurance Scene

Are you a motorcycle enthusiast in Florida? Understand the insurance landscape to protect your ride without breaking the bank. This guide dissects the cheapest places to get motorcycle insurance in Florida, navigating through the state’s requirements and the factors influencing rates.

State Requirements For Motorcycle Insurance

Florida’s laws are specific for motorcycle riders. Insurance is not just an option; it’s a necessity. Here’s what the Sunshine State demands:

- Property Damage Liability (PDL): Covers damages you may cause to someone else’s property.

- Bodily Injury Liability (BIL): Deals with injuries to others if you are at fault in an accident.

Florida’s no-fault law does not apply to motorcycles, thus PIP is not required. Yet, keeping coverage in mind is beneficial.

Factors Influencing Motorcycle Insurance Rates In Florida

The insurance premium can vary based on several factors:

| Factor | Description |

|---|---|

| Riding Experience | More experience may lead to lower rates. |

| Motorcycle Model | Sporty, high-end bikes could increase premiums. |

| Driving History | A clean record can mean favorable rates. |

| Location | Rates fluctuate by city and neighborhood. |

| Security Measures | Investing in anti-theft devices might reduce costs. |

Combine these factors with the right insurer to ensure you receive the best coverage at the lowest price.

Hunt For Affordable Motorcycle Insurance

Motorcyclists in Florida face a unique challenge. Insurance rates can soar high. Yet, finding budget-friendly coverage is a vital ride companion. Embark on a journey to trim costs without compromising safety. Ready to throttle through the maze of motorcycle insurance options? Let’s kickstart the engine.

Comparing Quotes: The First Step To Savings

Ever shopped for a bargain? That’s a quote comparison. Secure affordable rates by gathering multiple quotes. Ensure each policy matches your riding profile. Don’t shy away from details. Accurate information yields the best results. Below is the process:

- Collect information: Your motorcycle, driving history, and coverage needs.

- Reach out: Contact insurers online or via phone. Request their best offers.

- Analyze benefits: Each policy brings unique advantages. Evaluate beyond price.

- Review customer feedback: Others’ experiences provide insight into a company’s service quality.

When done right, comparisons promise not just savings but peace of mind on open roads. Let’s continue to weigh online against in-person insurance shopping.

Online Vs In-person: Pros And Cons

| Online | In-Person |

|---|---|

| Convenience: Shop anytime, anywhere. Speed: Immediate quotes, quick comparisons. Lower costs: Often cheaper with less overhead. | Personal touch: Face-to-face interaction. Tailored advice: Custom insights from agents. Local knowledge: Area-specific information. |

Online insurance shopping offers unmatched convenience and speed. Access quotes with clicks. Yet, personal interaction lacks. Without an agent, you decode policy jargon solo.

In contrast, in-person shops provide personalized service. An agent can navigate through complex coverage plans. Local understanding is their ace. Engage with them, and unearth discounts you didn’t know existed.

Both methods serve different riders well. Your particular needs dictate the choice. Combining the two may also yield ideal coverage. Embark on your insurance quest informed and ready to save.

Discounts And Deals On Two Wheels

Florida’s sunny roads are perfect for motorcycle enthusiasts. Insurance costs can weigh heavy. But, smart riders know the secrets to snagging deals. Here’s how you can rev up the savings on motorcycle insurance, keeping more cash to fuel your two-wheeled adventures.

Qualifying For Motorcycle Insurance Discounts

The right discounts can make a difference. Here’s what insurers often look for:

- Safe Driver – No accidents? Expect savings.

- Defensive Driving Courses – Certificates might lead to deals.

- Anti-theft Devices – A secured bike brings down premiums.

- Age and Experience – Age often equals lower rates.

- Membership Affiliations – Clubs can mean cuts.

Ask insurers about potential discounts. Be proactive. Stay updated.

Bundling Policies: A Strategic Move

Combine insurance policies for wider coverage. A single provider for home, auto, and motorcycle insurance simplifies processes. This strategy often triggers generous discounts. Table below breaks down potential savings:

| Type of Policy | Possible Discount |

|---|---|

| Auto + Motorcycle | Up to 10% |

| Home + Motorcycle | Up to 15% |

| Auto + Home + Motorcycle | Up to 20% |

Ensure all details match across policies for a seamless discount application.

Credit: bagenlaw.com

Local Gems: Finding Cheaper Rates Regionally

Believe it or not, Florida has hidden spots for affordable motorcycle insurance. It’s not just about the big-name providers. In some local areas, rates can be kinder to your wallet. Let’s explore how different regions can offer cost-effective solutions for your bike’s coverage.

Spotlight On Cities And Counties With Lower Premiums

Varied factors like traffic volume, crime rates, and accident statistics mean premiums can change significantly from one place to another. Let’s put the spotlight on a few areas where Floridians might find lower insurance costs.

- Gainesville: Known for its student population, has competitive rates.

- Panama City: Less traffic leads to more savings on premiums.

- Fort Myers: A mix of mature riders and good weather lowers risk factors.

| City/County | Estimated Savings |

|---|---|

| Gainesville | Up to 15% |

| Panama City | Up to 10% |

| Fort Myers | Up to 12% |

The Role Of Local Insurance Brokers

Don’t overlook the power of local expertise. Brokers in your area know the ins and outs of regional insurance landscapes. They use this knowledge to get you deals you might miss on your own. Here are ways they can help:

- Local brokers spot discounts tailored to your region.

- They negotiate with insurers, thanks to their community relationships.

- They provide personalized advice based on your riding habits and location.

Connect with a broker to tap into those regional “sweet spots” for motorcycle insurance savings. Remember, every dollar counts and local knowledge could lead to significant savings!

Big Name Insurers Vs. Local Agencies

Finding affordable motorcycle insurance in Florida pits big-name insurers against local agencies. Riders seek low rates and reliable coverage. Each offers unique benefits. Let’s explore and discern who could grant you the best deal on motorcycle insurance.

The Battle For The Best Rates: Contrast And Compare

On one corner, big-name insurers flaunt national reputations and extensive coverage. Benefits include:

- Widespread availability

- 24/7 customer support

- Comprehensive policy options

In the opposite corner, local agencies showcase personalized service and regional expertise. They bring:

- Custom policies tailored to Florida riders

- Knowledge of local laws

- Often-better rates

A detailed rate comparison reveals who might win your business.

| Provider Type | Pros | Cons | Average Cost |

|---|---|---|---|

| Big-Name Insurers | Reliability, Variety, 24/7 Support | May be pricier, Less personalized | $XXX |

| Local Agencies | Personalized service, Local expertise | Smaller support teams, Limited reach | $XXX |

Why Smaller Agencies Might Offer Lower Prices

Smaller local agencies can surprise you with their competitive pricing.

Reasons include:

- Fewer overhead costs

- Direct customer relations

- Niche market focus

They adjust rates based on specific Florida factors.

Their business model prioritizes community presence over national advertising.

This often results in lower premiums for you.

Selecting the right insurance provider demands careful consideration. Both big names and local agencies possess distinct advantages. Assess your individual needs. Choose the blend of price, service, and stability that suits you best.

Tailoring Your Coverage To Cut Costs

Seeking the cheapest motorcycle insurance in Florida often leads to a puzzle of coverage options. Smart riders know the trick to lowering costs isn’t just finding discounts; it’s tailoring coverage for maximum savings.

Minimum Vs. Full Coverage: A Cost Analysis

Florida law requires minimum motorcycle insurance coverage. But is it enough? Let’s compare:

| Minimum Coverage | Full Coverage |

|---|---|

| Cheaper premiums | More protection |

| Covers basic liabilities | Includes collision and comprehensive |

| Limited payouts | Higher limits for peace of mind |

Choosing minimum coverage cuts costs in the short term. Yet, in case of an accident, full coverage can save you from hefty out-of-pocket expenses.

Adjusting Deductibles For Affordable Premiums

Adjust your deductible to control insurance costs. A higher deductible means lower premiums. Consider these points:

- Can you afford to pay more out-of-pocket after an accident?

- Is saving on monthly premiums worth the increased risk?

- Assess your riding habits and financial safety net.

Balance is key. Pick a deductible that keeps premiums affordable, yet doesn’t leave you stranded after a mishap.

Policyholder Profiles: Who Gets The Best Rates?

Matching your profile with the most affordable options is key. Let’s dive into the essentials of policyholder profiles and who enjoys the best rates.

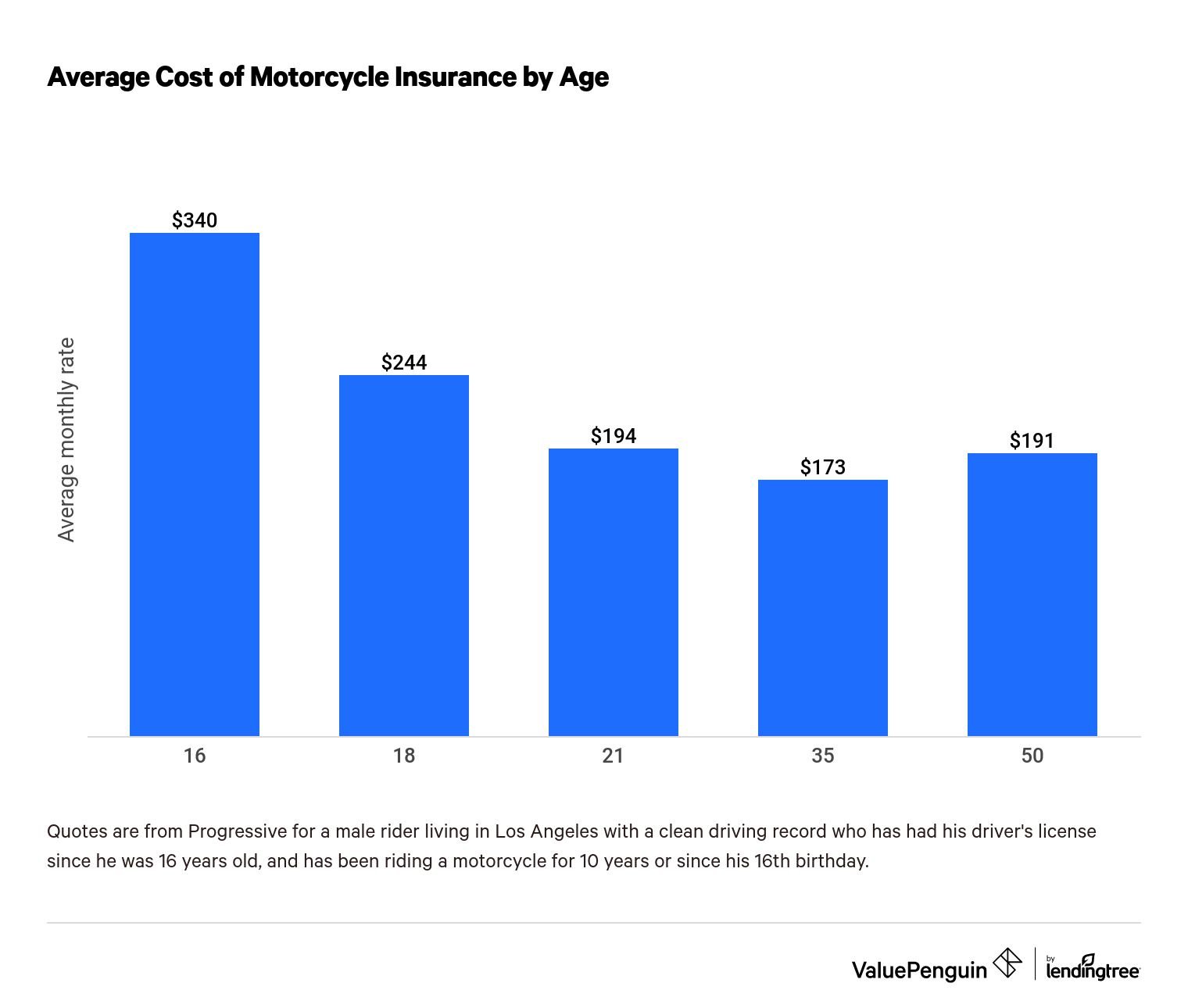

Age, Experience, And Motorcycle Types Affecting Costs

Age is a significant factor in determining insurance costs. Young riders under 25 typically face higher rates due to inexperience. Conversely, riders over 25, with more experience, often see lower premiums.

Riding experience matters. Those with years of riding under their belts benefit from reduced rates. Insurers see experienced riders as less of a risk.

Motorcycle types greatly influence insurance costs. High-performance bikes attract higher premiums than their standard or touring counterparts. As such:

- Sportbikes may cost you more in insurance.

- Touring bikes are often cheaper to insure.

The Impact Of Driving History On Insurance Quotations

A clean driving record can greatly reduce insurance premiums. Conversely, accidents and violations can lead to higher rates. Consistently safe riders are rewarded with more competitive quotes.

Insurance companies usually examine your last three to five years of driving history. A profile with:

| Profile | Impact on Rates |

|---|---|

| No violations | Lower rates |

| Multiple violations | Higher rates |

It’s important to know that completing a motorcycle safety course could positively affect your premiums, regardless of your driving history.

:max_bytes(150000):strip_icc()/what-is-the-average-cost-of-motorcycle-insurance-527362_FINAL-50c0673de76a4d478a4040b170acadb3.png)

Credit: www.thebalancemoney.com

Leveraging Technology For Cheaper Insurance

In an ever-evolving digital world, savvy riders in Florida are now turning to technology for cost-effective insurance solutions. Smartphones and the Internet are not just tools for staying connected. They are gateways to securing affordable motorcycle insurance in the Sunshine State.

Mobile Apps And Online Tools For Insurance Shopping

Motorcycle insurance shopping in Florida has never been easier. The digital revolution introduces a plethora of mobile apps and online tools dedicated to helping riders find the best insurance deals.

- Comparison apps streamline policy options.

- Instant quote tools provide swift estimates.

- User-friendly interfaces simplify the process.

Utilizing these tools translates to precious savings in both time and money. Riders can compare rates, coverage details, and customer reviews at a glance.

The Rise Of Telematics In Reducing Motorcycle Insurance Costs

The adoption of telematics technology reshapes how insurers calculate premiums in Florida. By fitting motorcycles with telematics devices, riders can showcase their safe driving habits directly to insurers.

| Benefits of Telematics: |

|---|

| Personalized insurance rates based on actual riding behavior |

| Rewards for safe riding with potential discounts |

| Real-time data for tailored insurance packages |

Motorcyclists can leverage lower insurance costs through responsible riding, with evidence backed by telematics. Insurance companies offer discounts for those who exhibit consistent, safe on-road practices confirmed by real-time data.

Also Read: Helmet Fogging Up? Check What To Do.

Riding Into The Future: Anticipating Changes In Rates

Motorcyclists in Florida often seek the best deals on insurance. Knowing the future can save money. Rates change for many reasons. We’ll explore future trends here. Economic factors and laws can affect rates. Stay ahead with these insights.

Predicting The Influence Of Economic Factors

Insurance costs relate to the economy. Inflation and recession impact rates. Here’s how:

- Inflation: Higher costs mean more expensive repairs. Insurance companies may raise rates to cover this.

- Interest Rates: High interest means higher operating costs for insurers. This can lead to increased premiums.

- Unemployment: More jobless means fewer people driving. Lower risk can decrease insurance costs.

Awareness of these factors helps you find better rates.

Legislative Changes And Their Effect On Motorcycle Insurance

Laws can redefine insurance landscapes. Here’s a forecast:

| New Laws | Possible Effects |

|---|---|

| Safety Regulations | Better gear can lead to fewer claims and lower rates. |

| License Requirements | Stricter tests can mean more skilled riders and fewer accidents. |

| Insurance Minimums | Higher coverage requirements could increase base rates. |

Stay updated on laws to predict your insurance costs.

Credit: www.valuepenguin.com

FAQ

What’s The Most Affordable Bike Insurance In Florida?

The most affordable motorcycle insurance in Florida varies by insurer and personal factors, but companies like GEICO and Progressive often offer competitive rates. Always compare quotes to find the best deal.

How Can I Lower My Motorcycle Insurance Costs?

To reduce motorcycle insurance costs, consider increasing your deductible, taking a safety course, bundling policies, and maintaining a clean riding record. Make sure to leverage any available discounts.

Are There Specific Discounts For Florida Riders?

Yes, Florida riders may qualify for discounts such as the mature rider discount, multi-bike discounts, and discounts for being a member of certain motorcycle associations. Be sure to ask insurers about state-specific offers.

What’s The Minimum Insurance Requirement In Florida?

Florida requires riders to carry at least $10,000 in medical benefits and $10,000 for financial responsibility for property damage. Motorcycle liability coverage is surprisingly not mandatory in Florida.

Bottom Line

Securing affordable motorcycle insurance in Florida is achievable. We’ve fact checked several budget-friendly providers sure to meet diverse rider needs. Always compare policies and seek discounts to ensure the best deal. Ride with peace of mind, knowing your choice blends economy with quality coverage.

Leave a Reply